Redefine the way you work.

Making consultancy more efficient.

The traditional consultancy engagement process can be time-consuming, manually intensive and prone to variations in consistency depending on individual consultants. That's why we've developed an innovative platform that leverages the power of agentic AI to streamline the process, making it faster, more accurate, and more efficient.

An enterprise-ready production hub for managing multiple assignments.

Automated Proposals.

With Meridia's advanced AI capabilities, you can quickly scope new projects by having our models automatically generate draft project plans, work breakdown structures and resource estimates.

Effortless data summarisation.

Our multi-model AI engine enables you to summarise information efficiently - from IMs to Information Request Lists, documents to diagrams - the Meridia platform can drastically reduce your manual effort.

Built-in AI Assistant.

Our AI assistant, George, eliminates the wasted effort of your consultant's time by providing coherent, contextual output from their unstructured input, utilizing all available models along with customizable guidelines for tone, format, and content.

Automated report generation.

Rather than manually stitching together findings into a report, Meridia automatically generates polished narratives in real-time by analysing conversational outputs, documents, data extracts and observations.

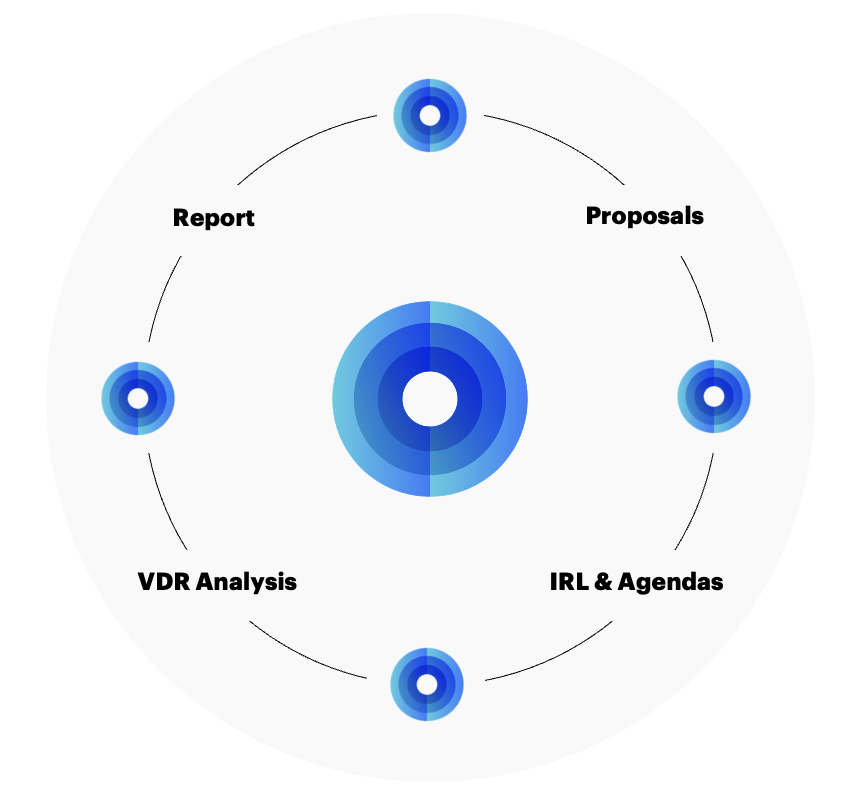

Automated assistance from proposals to final reports.

Meridia is a comprehensive advisory solution built for the modern age. Our platform combines powerful automation with advanced AI to streamline every step of the diligence process from initial proposals, scoping, IRLs through to report generation and configurable formatting.

Fully configurable workflows and agentic AI models deliver high-quality research and easy-to-digest outputs.

Inconsistency or lapse in quality can undermine credibility and jeopardise repeat engagements. Meridia eliminates those risks by combining intelligent workflows, configurable templates and AI-assistance to deliver consistent reports in a 'house style' regardless of the consultant used. Your teams use their expertise to establish the findings and your configured, standardised processes to ensure quality, consistency and compliance.